HOW TO CONSTRUCT A BUDGET

Using Google Sheets

Introduction

The only way to avoid money problems is to spend less than you earn; in other words, "live within your means".

Unless you have more money than you can spend, "living within your means" requires forethought and planning, in order to meet your needs without exceeding your income.

I have been budgeting since 1991. It isn't rocket science. There's nothing about budgeting that you couldn't figure out on your own, eventually. The only reason you might be interested in what I have to say is because it could save you thirty years.

NOTE: Step-by-step instructions for recreating the tables pictured here may be found in the addendum.

The Basics

Handling money responsibly boils down to two simple rules: Spend Less Than You Earn and Save In Advance.

The tables that follow are designed to help you do that the easiest way possible.

Let's get started!

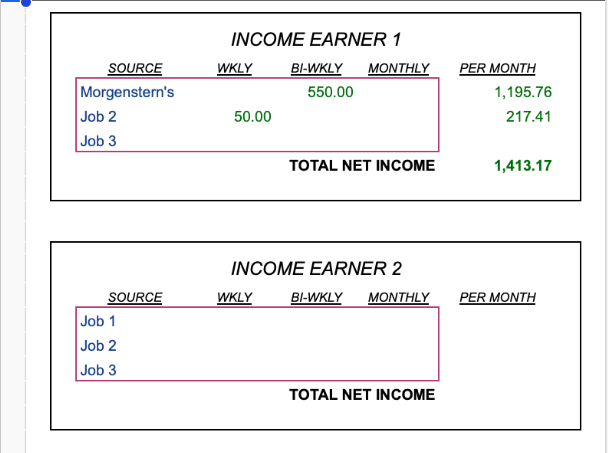

1 INCOME

The term "income", as used here, refers to net income - the money you actually have to work with.

The Income Table calculates how much money you have to work with, per month - the standard billing cycle.

The Income Table:

The Income table contains columns for most common pay periods: weekly, bi-weekly, and monthly.

For each source of income, enter net income per pay period in the appropriate column.

The table automatically calculates Total Net Income per month.

You'll need to complete an Income table for each income earner in the household.

2 EXPENSES

An "expense" is the cost of something; money spent.

Rent, Utilities, Groceries, and Meals Out are all examples of expenses. Two of them are easy to budget for, and two are not. Can you guess which is which?

When the amount and due date are known in advance, budgeting is easy. When the amount and due date are not known in advance, a different method must be employed to get an accurate estimate.

For expenses where the amount and due date are known in advance, you'll use the Payments table. For all other expenses, you'll use the Purchases table. Both tables automatically convert your entries to a monthly amount.

Completion of the two tables constitutes a Preliminary Draft of your budget.

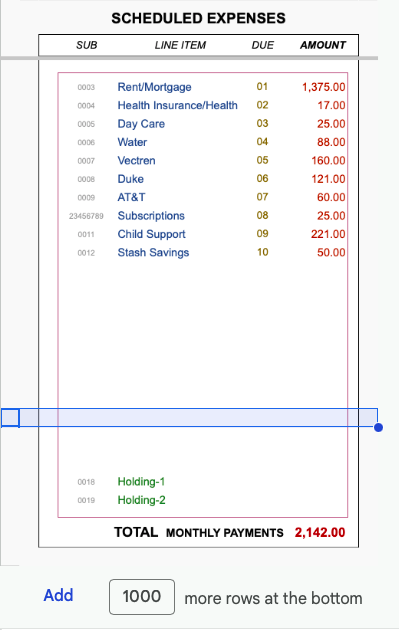

2a The Payments Table:

Different kinds of Payments

Most Payments are due every month: Rent, Utilities, Streaming Svcs, etc.. However, not all payments are monthly payments

Auto Registration (due annually) and Auto Insurance (if paid quarterly) are by definition Payments, because the amount and due date are known in advance.

They may not be due every month; however, they're estimated using the same method as monthly payments , so you will list them on the Payments table.

Longer-term payment like these have the added advantage of allowing you more time to Save In Advance (allocate money) for them.

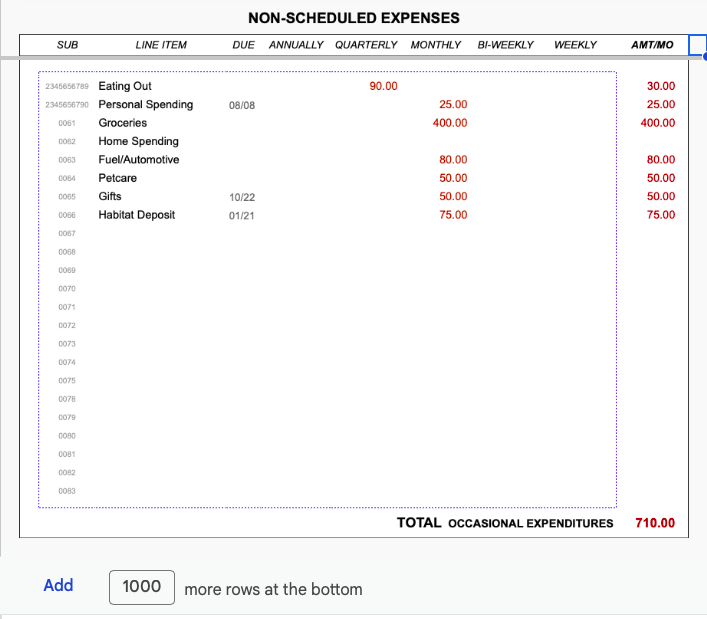

2b The Purchases Table:

Purchases

Purchases are "ad-hoc" expenses, not scheduled in advance. There is no contract, agreement, or statement specifying an amount or due date.

Take "Groceries", for example. You're likely to go to the grocery as needed, rather than on a specified date, not knowing how much it will cost.

How do you know how much to set aside each month for this type of expense?

Estimating the Unknown

What I suggest is to go through your check book or online credit card statments, to see how much you spent the previous year.

Enter the total in the Annual column on the Purchases table. Let the table do the math; it saves time and avoids errors.

Too much work? Okay. Guesstimate. You're going to revise it anyway.

Another example: if a Google search suggests maintenance on your vehicle averages $1500/year, enter 1500 in the Annual column on the Purchases table.

The table automatically converts your entry to a monthly amount, no fuss, no muss.

For most Payments, notification of an amount and due date arrives in the form of a statement (Rent/Mortgage payments and loan payments being exceptions; a contract takes the place of the statement).

It's Always Somethin'

There is a group of expenses that seem to defy classification: appointments.

Appointments may be scheduled in advance, and may even carry a co-pay known in advance.

However, whether an appointment expense lives on the Payments table or the Purchases table depends on the following:

If you pay at the time of service (no statement), it's a Purchase.

If at the appointment you request a statement be sent, deferring payment, it's a Payment.

If ever in doubt about whether an expense is a Payment or an Purchase, the presence/absence of a statement (or contract) is the final arbiter.

The CIE

I can't count the number of times I've heard people say budgets don't work. A client once told me the reason she hated budgets is because they just show her all the things she can never have.

"I get it," I said. "The reason I never look both ways before crossing the street is because there might be a car coming."

Nothing renders a budget useless more quickly than neglecting to include an expense. To guard against the inevitable, a Comprehensive Index of Expenses (CIE) is provided, listing expenses often overlooked.

Tracking Expenses

A template is provided for tracking expenses. It covers a period of up to thirty-one days.

Save the template, and make two or three copies (how to make copies and rename them is explained later).

Two or three months of tracking expenses, comparing actual spending to your working draft, and making adjustments to both, will yield a Final Draft, a Sound Spending Plan, a reliable BUDGET.

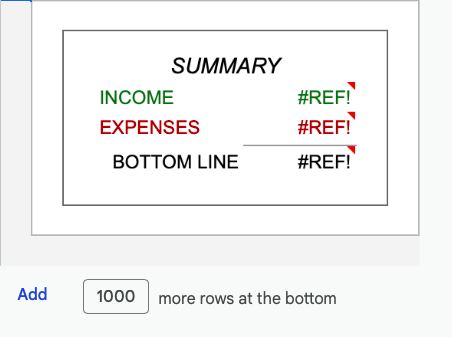

3 Summary

The Summary Table:

The Summary indicates whether your budget meets your needs without exceeding your income

If the BOTTOM LINE is less than zero, the answer is "NO".

If the BOTTOM LINE is greater than zero, you have money that isn't being used.

If the BOTTOM LINE is zero, you have a Sound Spending Plan.

7

PUTTING IT ALL TOGETHER

Where to Begin:

The first step is to determine how much you spend per month.

Use a Tracking Sheet provided for that purpose.

Enter both Income and Expenditures.

The Tracking Sheet template.

The tracking sheet template provided - a cross between an expense record and a calendar - covers a period of 31 days, and calculates subtotals for up to fourteen budget Categories.

It can be duplicated easily, and the copies renamed to provide a tracking sheet for each month.

Expenditures are automatically subtracted from Income.

By entering Payments in advance, and Expenses as they occur, you can see whether you'll have enough money to last until payday, or whether you can afford an unplanned purchase.

Two months of tracking information is usually sufficent to provide enough data for a Preliminary Draft.

A tracking sheet is a very handy thing to have, and a great visual aid. But it quickly becomes too burdensome to be practical over the long haul. I used it for seven years before finding an suitable replacement.

What used to take anywhere from 90 minutes to three hours every night, in 1991, now takes no more than 2 to 5 minutes every morning, and four to ten minutes whenever a statement arrives.

As you gain confidence in handling your finances, and sufficient faith in the system, you'll no longer feel a need to track expenditures and can "graduate" to the COMPTROLLER. Indeed, you will have arrived.

8

The COMPTROLLER:

The Comptroller lets you stay on top of everything, without the details. I gives you immediate access to all the information you need to make prudent spending choices, 24/7, anywhere with a phone signal or internet connection.

9

ALLOCATION

The Allocation table:

An allocation table calculates each income earner's contribution toward household expenditures.

10

P-Val:

.

1.png.)

.

.

11

A Final Word:

Because all of these tables talk to one another (except for the CIE), adjustments made to one Preliminary Draft are reflected in the Summary table.

A Bottom Line of zero or greater (on the Summary Table) indicates a sound plan for living within your means.

The Final Draft, one that shows how to meet your needs without exceeding your income, is a Sound Spending Plan.

Seque to Part 2:

Budgeting is easy. Behaviorr modification is not.